Some Known Questions About Paul B Insurance.

Table of ContentsThe 5-Minute Rule for Paul B InsuranceThe Definitive Guide to Paul B InsuranceFascination About Paul B InsuranceNot known Facts About Paul B InsuranceWhat Does Paul B Insurance Do?

At the same time, unlike the majority of established nations, the United States wellness system does not supply health care to its entire populace. As there is no single across the country system of health insurance, the United States largely counts on companies that voluntarily give medical insurance protection to their workers and dependents. On top of that, the government has programs that often tend to cover health care costs for the delicate parts of the culture as the elderly, handicapped as well as the inadequate.Obtaining medical insurance in the US is not an easy thing. Somebody might believe that as soon as you have money every little thing is easy peasy, however as a matter of fact things are a little bit extra difficult. One should be very careful as well as watch out to choose the right insurance policy. The United States government does not give health and wellness insurance for all its people, as well as wellness insurance coverage is not required for those living in the US.

There are two kinds of health insurances in the US, private and public. The US public health insurances are: Medicare, Medicaid, as well as Kid's Wellness Insurance coverage Program.

Indicators on Paul B Insurance You Should Know

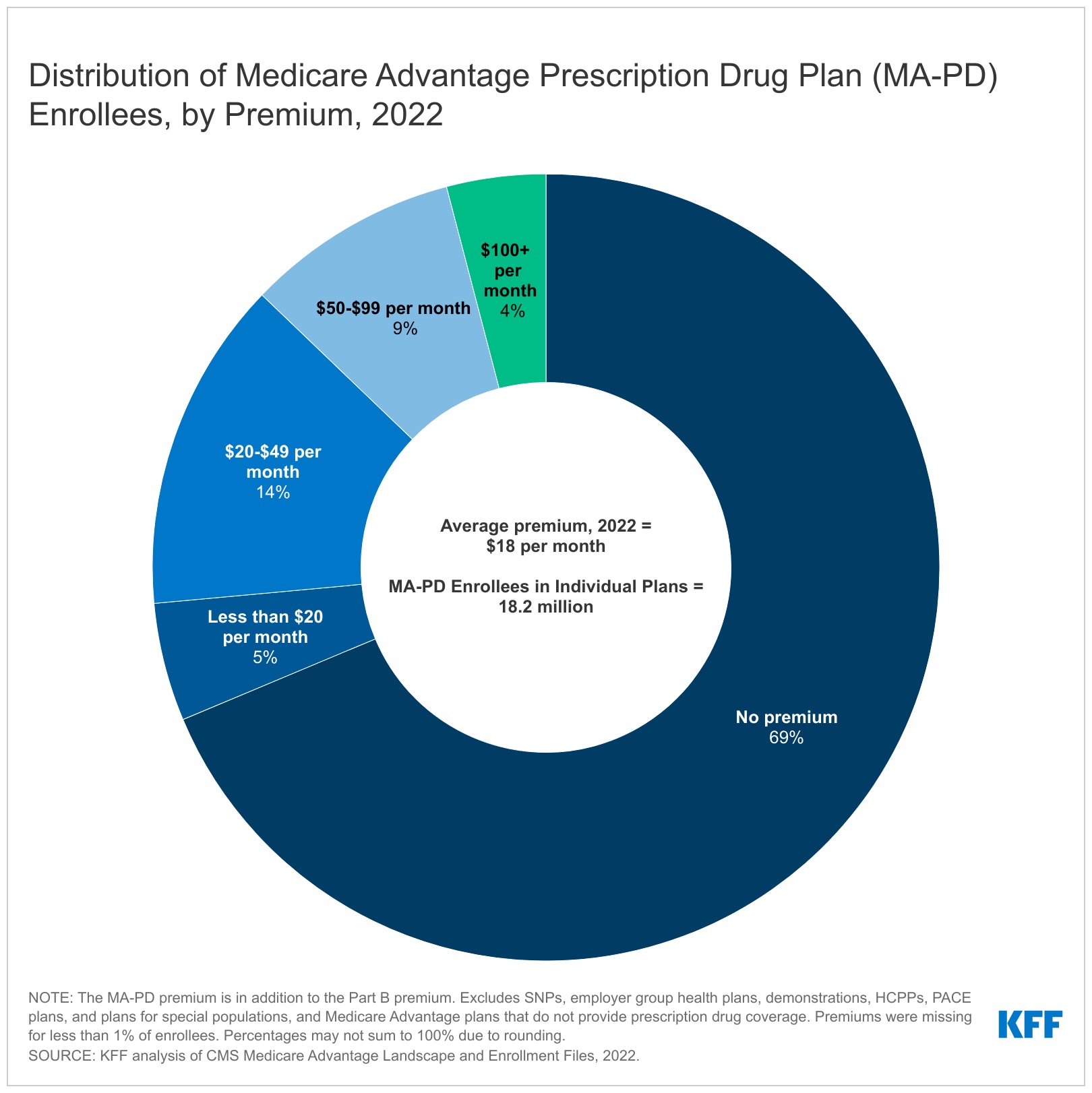

It offers health insurance for United States nationals older than 65 years old, however likewise for younger individuals with end stage kidney illness, ALS, and a few other handicaps. Information reveals that in 2018, Medicare offered almost 60 million people with healthcare in the United States, over 51 million of which were older than 65.

covers outpatient solutions, including some companies' services while inpatient at a health center, outpatient healthcare facility fees is an alternative called Managed Medicare, which allows people to choose wellness strategies with a minimum of the very same service insurance coverage as Component An and B, often the benefits of Component D, and also an annual out of pocket spend restriction which An and B lack.

covers primarily self-administered prescription medicines. Medicaid is a federal and also state program that helps people with restricted revenue and sources to cover clinical costs, while covering benefits usually not covered by Medicare, as assisted living facility treatment and individual care services. It is the largest source of financing for clinical and also health-related services for individuals with reduced revenue in the United States.

Getting The Paul B Insurance To Work

Previously called the State Children's Medical insurance Program (SCHIP), this is a program that covers with medical insurance children of families with small earnings, that are not reduced enough to receive Medicaid. The Individual Security as well as Affordable Care Act is a government statute authorized into law by President Obama, that made it obligatory for every single resident to have medical insurance or be penalized.

Usually, there are three kinds of medical insurance in the United States: which strategies are normally one of the most costly, that those with a revenue reduced than the average income in the US, have difficulties to purchase. These are the ideal strategies as they supply you most flexibility. which offers a limited selection of doctor, yet it additionally uses lower co-payments and also covers the prices of even more preventative treatment.

The Definitive Guide for Paul B Insurance

The United States Authorities have actually not made health and wellness insurance policy compulsory for short-term tourists to the nation, as B-1/ B-2 visa owners, it is very recommended for every tourist to obtain insurance coverage before their journey to the country. The primary reason you ought to obtain insurance policy is that healthcare in the United States is extremely expensive as well as even an exam for an easy frustration will certainly cost you hundreds of dollars, while a broken arm or leg will certainly cost you thousands.

The majority of the moment, "certified non-citizens" are eligible for coverage through Medicaid as well as Children's Medical insurance Program (CHIP), considered that they fulfill the revenue and residency rules of the state where they are based. "Qualified non-citizens" are taken into consideration the following: Legal irreversible residents Asylees, refugees, damaged non-citizens & partners, youngsters, or parents, victims of trafficking and his or her spouse, child, sibling, or moms and dad or people with a pending application for a target of trafficking visa Cuban/Haitian entrants, Those paroled into the United States for you can try these out at the very least one year Conditional participant provided prior to 1980 those given withholding of expulsion and also participants of a government acknowledged Indian People or American Indian birthed in Canada.

The 8-Minute Rule for Paul B Insurance

Medicare health insurance supply Component A (Health Center Insurance Policy) and also Component B (Medical Insurance coverage) advantages to people with Medicare. These plans are typically used by private firms that contract with Medicare. They consist of Medicare Benefit Program (Part C) , Medicare Cost Strategies , Presentations / Pilots, and also Program of All-inclusive Look After the Elderly (RATE) .

You must have the ability to watch your network of suppliers on your insurance firm's participant website or in a network supplier directory. You can additionally call the client service line and also speak with a rep. To evaluate your costs, look via your existing insurance coverage or see your insurer's member portal.